Understand your company's position and learn more about the options available

Require Immediate Support? Free Director Helpline: 0800 644 6080

Free Director Helpline: 0800 644 6080

The latest business distress index for Q4 2024 provides a picture of the financial health of UK businesses as they battle turbulent trading conditions, fuelled by the Autumn Budget announcement and an ongoing cost of living and trading crisis.

As the new government kickstarts efforts to recover funds for the Treasury, businesses must prepare to absorb higher taxes under the shadow of high inflation and low consumer confidence.

We look at how businesses fared throughout Q4 2024 (October to December) and connect the dots between the financial health of UK companies and the rate of UK insolvencies.

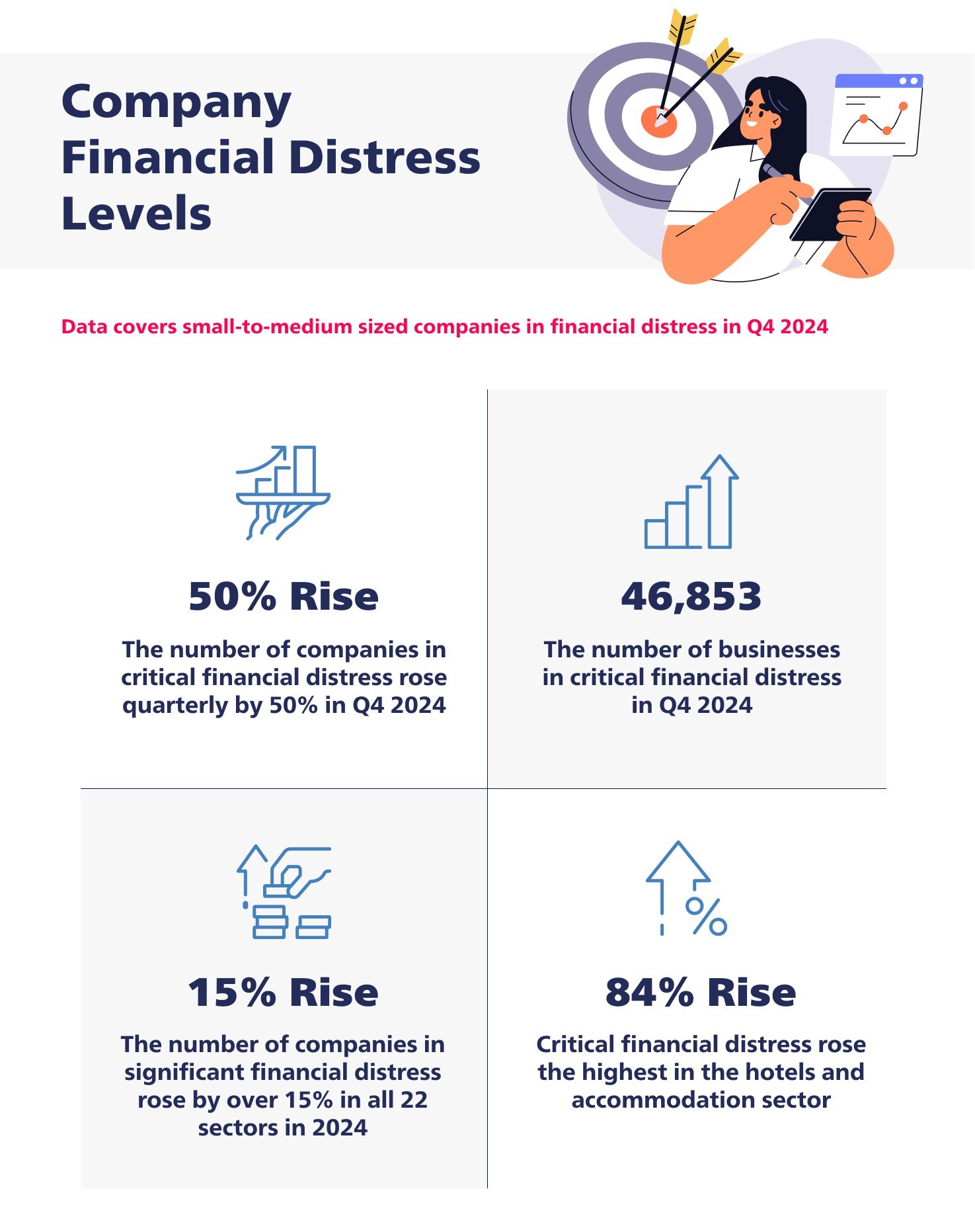

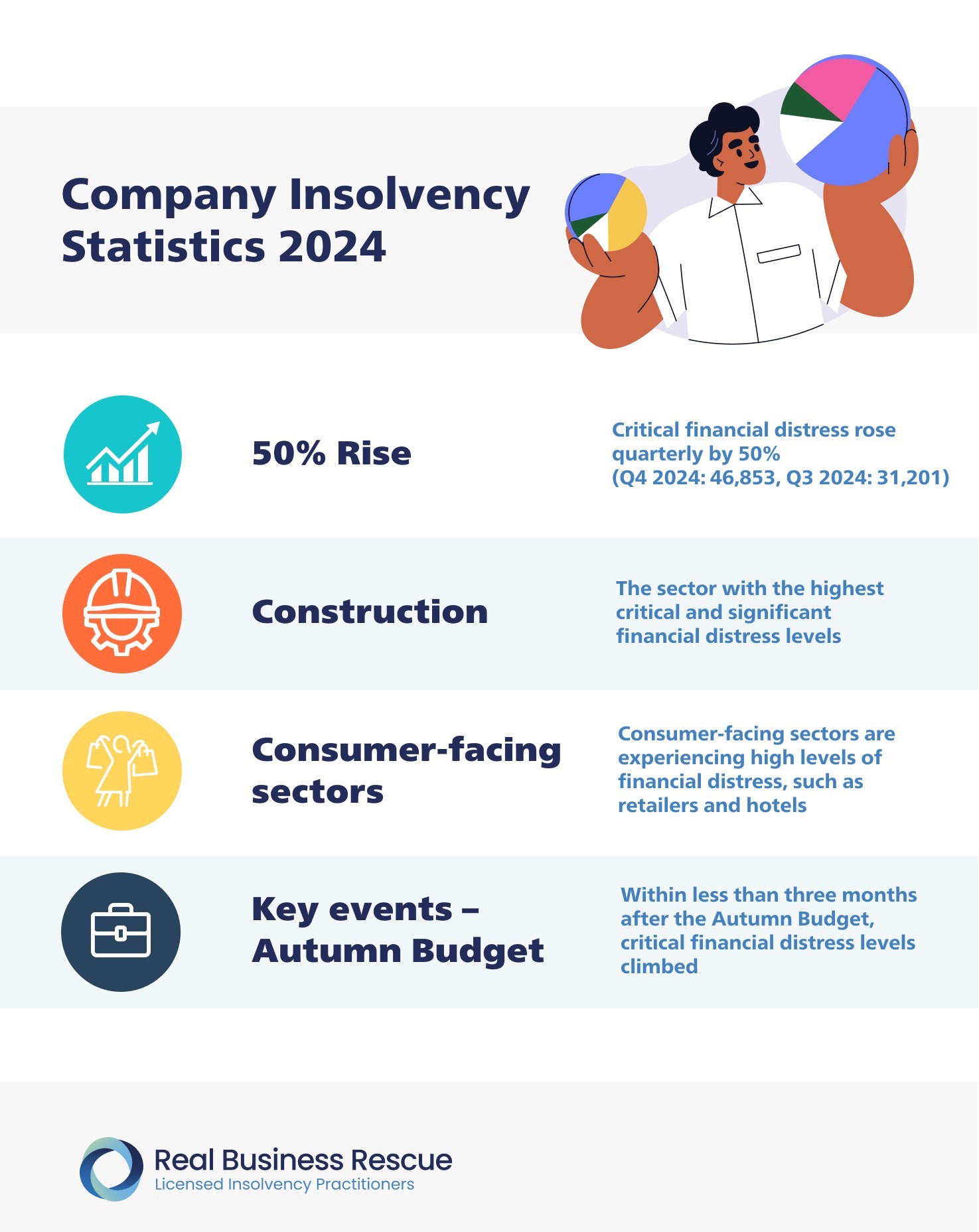

The Business Distress Index for Q4 2024 shows critical financial distress levels hiked by 50.2% to 46,853 in Q4 2024, compared to 31,201 in Q3 2024. Significant financial distress levels jumped by a modest 3.5% to 654,765, compared to 632,756 in Q3 2024.

Consumer facing sectors are the hardest hit, in particular Hotels & Accommodation (+83.6%), Leisure & Cultural Activities (+76.5%), General Retailers (+47.6%) and Food & Drug Retailers (+37.4%).

The number of significantly financially distressed businesses operating in key UK industries paints a concerning picture of financial health, with Construction (97,603), Support Services (90,375), and Real Estate & Property Services (75,394) on the top of the league table.

The Business Distress Index, which uses Red Flag Alert data, shows that financial distress levels increased by over 15% in all the 22 sectors monitored. This mirrors the financial strain experienced by UK businesses under the current trading climate, intensified by upcoming tax changes as we approach the 2025/26 tax year.

Shaun Barton, National Online Business Operations Director at Real Business Rescue, comments on the latest Business Distress Index Q4 2024 release:

“After an underwhelming Golden Quarter, businesses will have no alternative but to pull the plug if consumers continue to rein in non-essential spending during this unshakeable period of low growth.

“Paired with eye-watering borrowing costs and fast-approaching tax increases, businesses must heal themselves before they enter the new tax year. With National Insurance Contributions and National Minimum Wage set to rise, businesses must gear themselves for a testing year ahead.

“With particularly consumer-facing sectors facing unprecedented financial pressure, they may find themselves at a critical crossroads where they must unload some financial burden to secure a viable future.”

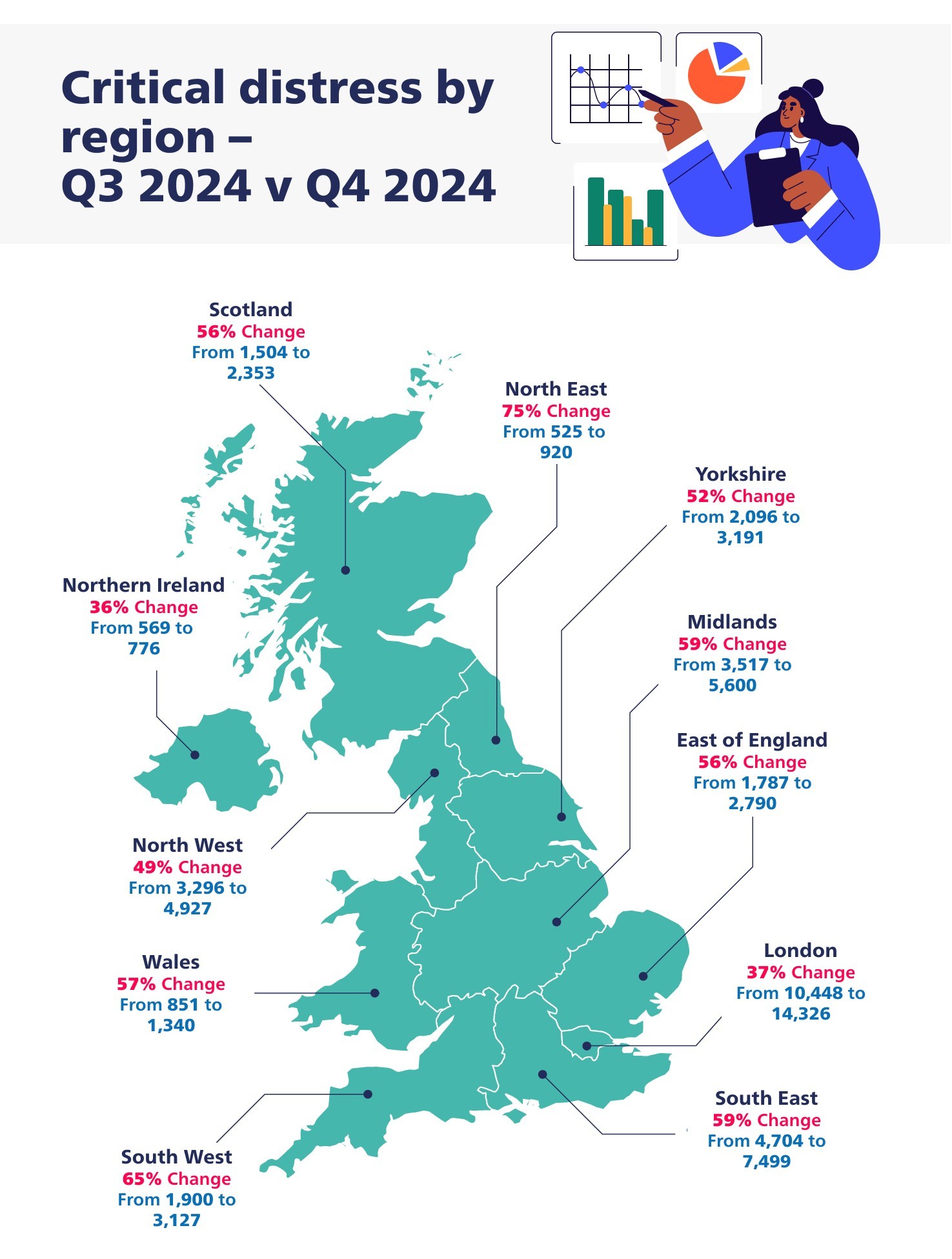

While London naturally has the highest volume of critically distressed businesses due to its prominence and size, the South East follows closely.

A substantial increase in critical financial distress levels in the North East in Q4 2024 compared to Q3 2024 stands out, as the number of critically distressed businesses skyrocketed from 525 to 920 – a significant 75% increase. This is substantially higher than the UK average rise of 50% compared to the previous quarter.

As UK businesses brace themselves for a turbulent quarter, an uplift in consumer spending is essential to improve trading conditions and restore business confidence.

Within less than three months of the Autumn Budget, critical financial distress levels climbed, mirroring the sharp decline in consumer confidence due to tax increases set to hit small businesses.

The Autumn Budget will play an instrumental role in the financial health of UK SMEs throughout the year. After a disappointing Golden Quarter, businesses are approaching the new tax year with significantly greater outgoings, yet little to no increase in income to break even.

With businesses left with no choice but to trim their outgoings to absorb the increase in National Insurance Contributions and the National Living Wage, as announced in the Autumn Budget, the increased cost of borrowing and restrained consumer spending compounds the problem.

If you are struggling with business debts, cash flow problems, and creditor pressure, we can help. Our licensed insolvency practitioners can help business owners navigate financial distress and reach stable ground. For expert advice on how to rescue or close a business, get in touch with a member of the Real Business Rescue team for a free, confidential consultation.

Call our team today on 0808 253 3818.

For Ltd Company Directors

What are you looking to do?

Choose below:

We provide free confidential advice with absolutely no obligation.

Our expert and non-judgemental team are ready to assist directors and stakeholders today.

Understand your company's position and learn more about the options available

Find your nearest office - we have more than 100 across the UK. Remote Video Meetings are also available.

Free, confidential, and trusted advice for company directors across the UK.