Understand your company's position and learn more about the options available

Require Immediate Support? Free Director Helpline: 0800 644 6080

Free Director Helpline: 0800 644 6080

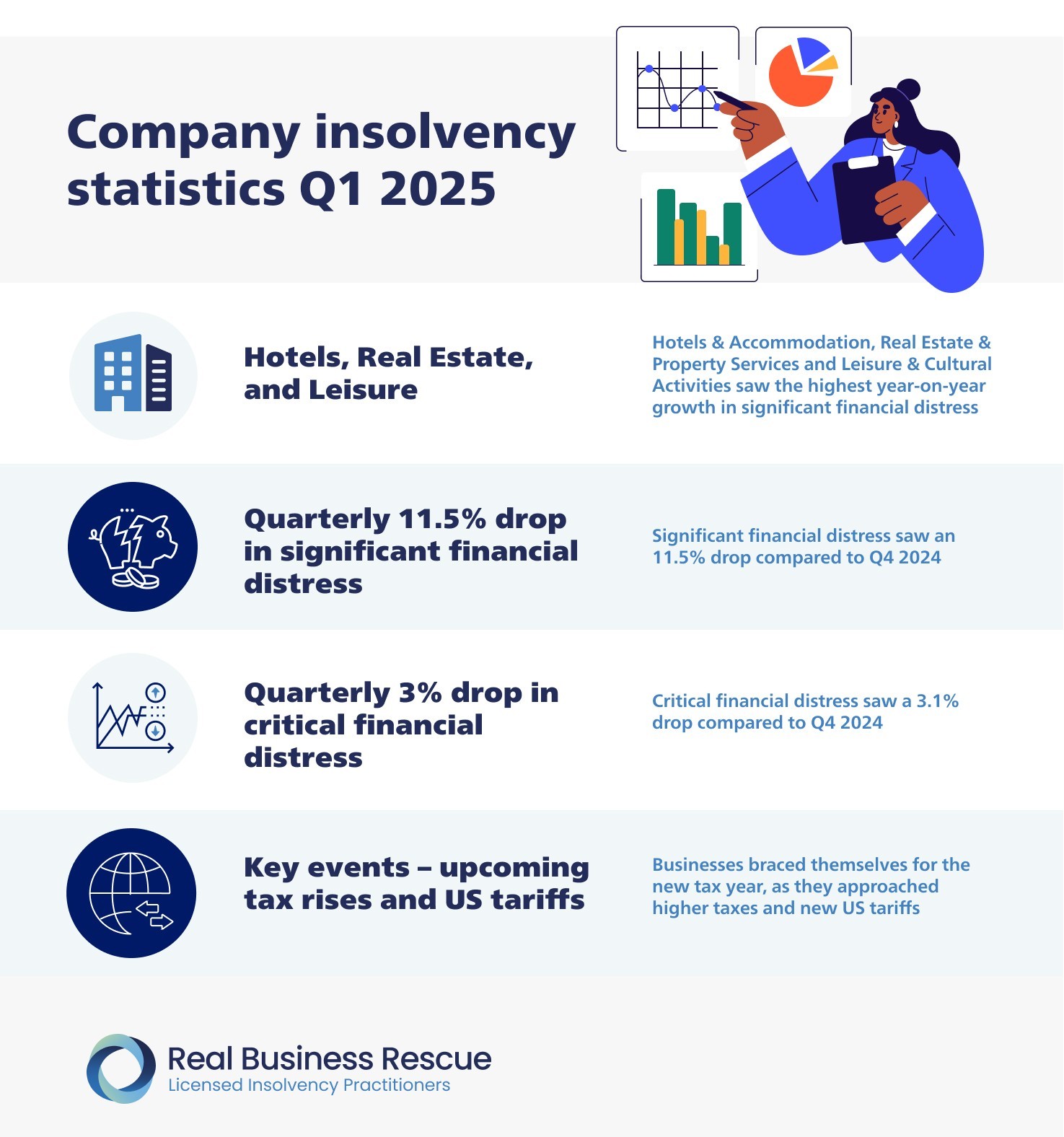

The playing field is thorny for UK companies as high inflation fuels expensive borrowing and business operating costs. The first quarter marks the final stretch before the new fiscal year, which means businesses must use this period to trim outgoings in light of higher tax liabilities from April 2025 as announced in the Autumn Budget, in addition to new US tariffs.

The Business Distress Index, published by Real Business Rescue uses data from Companies House and Red Flag Alert to measure financial distress levels across the small-to-medium business population in the UK. We look at company insolvency statistics for UK SMEs, including a regional and sector breakdown.

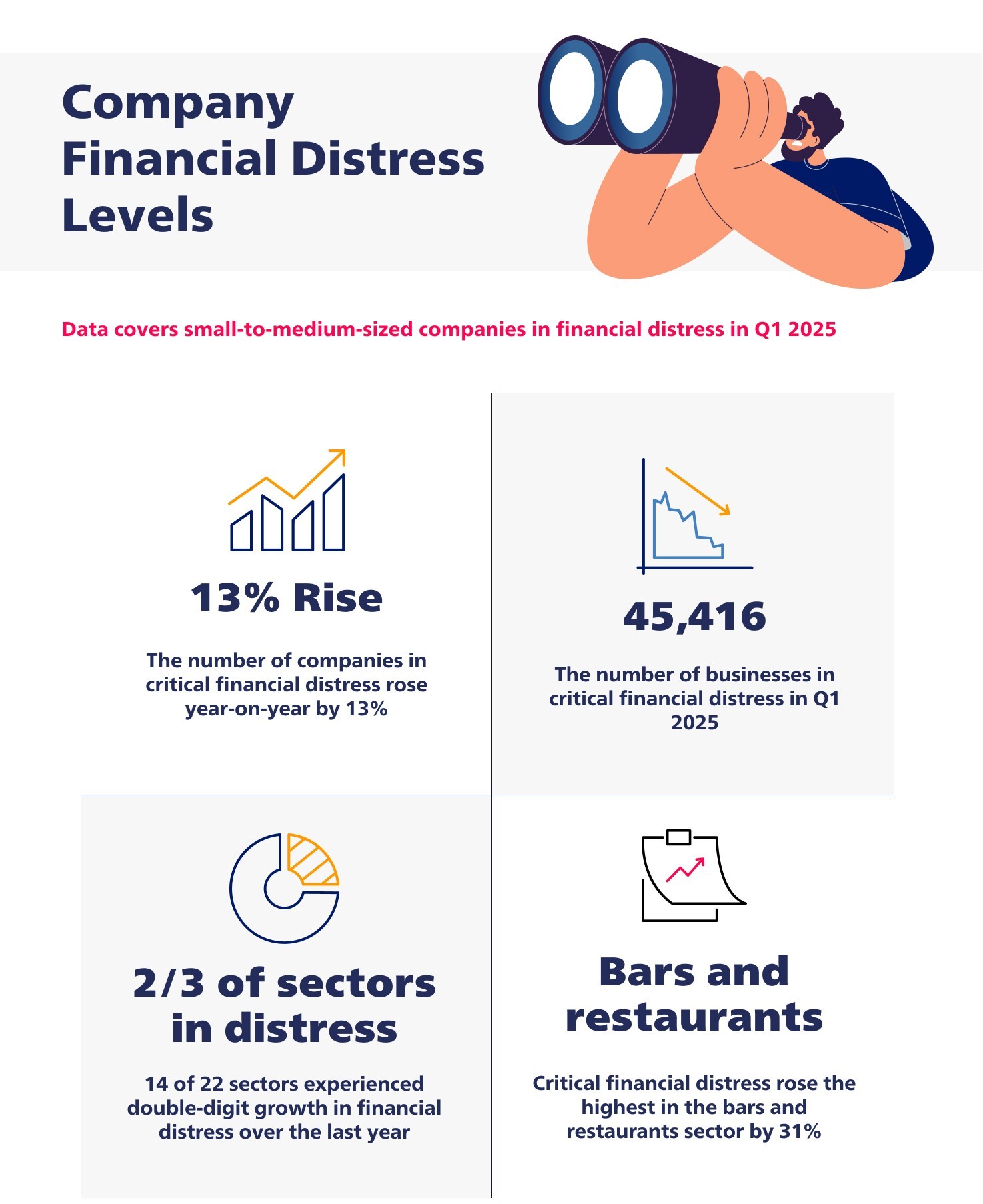

The number of SMEs in critical financial distress in Q1 2025 increased by 13% to 45,416 businesses, compared to 40,174 companies in Q1 2024. However, compared to the previous quarter, the number of companies in critical financial distress dropped by 3%. Critical financial distress relates to businesses showing severe signs of financial distress, including deteriorating working capital, retained profits and net worth.

When looking at the number of companies in significant financial distress, this increased 4.5% yearly with 579,276 companies in Q1 2025, compared to 554,554 companies in Q1 2024, despite a 11.5% drop quarterly drop (Q4 2024: 654,765).

This shows that while businesses had more breathing space at the end of 2024, trading pressure has been restored, with reduced financial flexibility due to rising overheads. As the economy moves towards higher taxes and tariffs, businesses must prepare to weather the increase in costs.

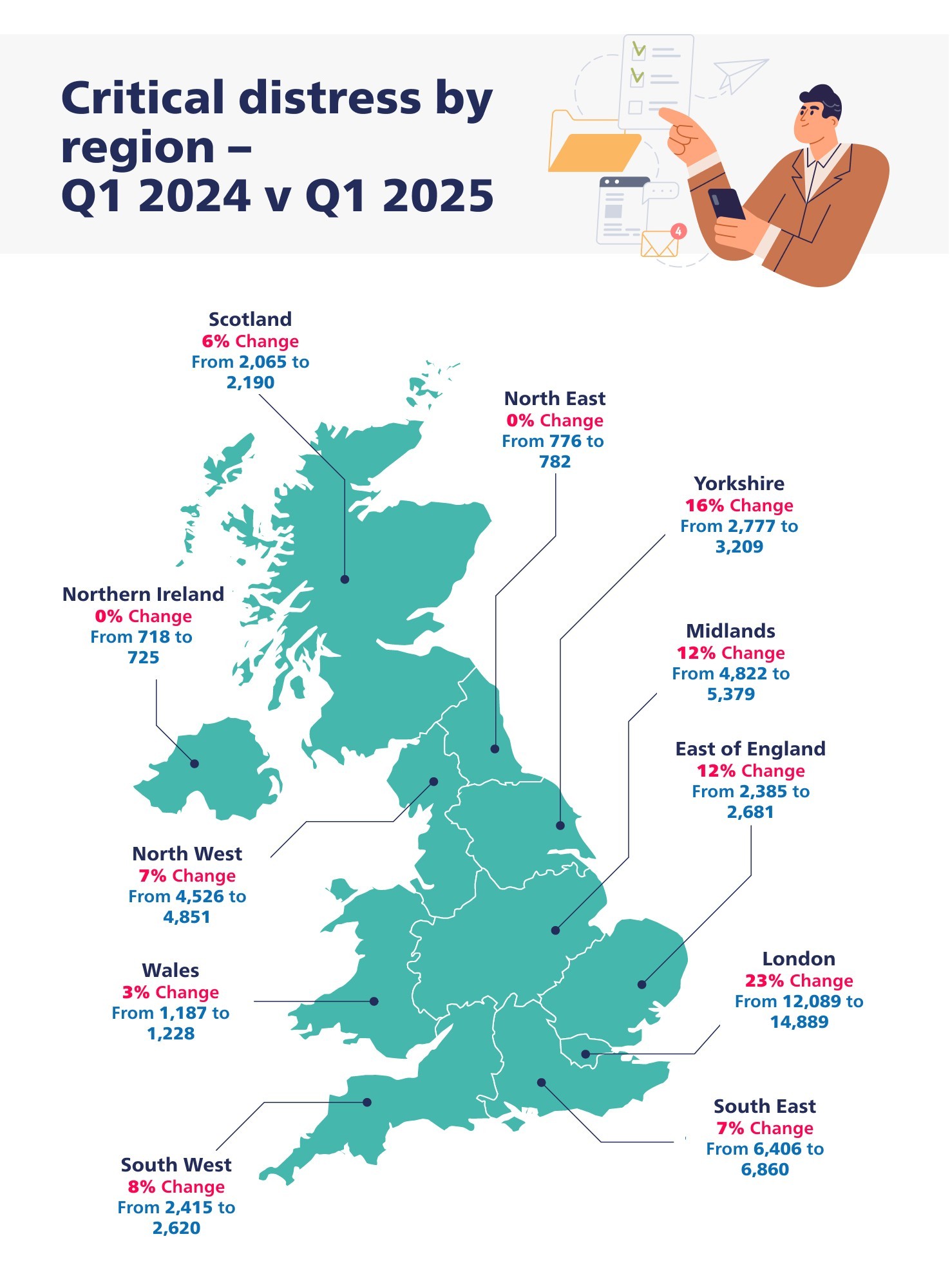

We look at the regional breakdown of company insolvency statistics compared to last year.

The industry with the highest quarterly rise in critical financial distress at +31.2% is Bars and Restaurants, closely followed by other consumer-facing industries: Travel & Tourism (+25.5%) and General Retailers (+12.4%). As the cost-of-living crisis persists, households are coping with meagre disposable income, which means reduced consumer spending and consequently, dips in profitability for businesses.

Out of 22 sectors assessed by the Business Distress Index, nearly two-thirds (14 of 22) saw double-digit growth in critical financial distress over the last year, highlighting the deteriorating state of the economy. More than a third of companies in critical financial distress are across Real Estate & Property Services, Construction and General Retail.

Significant financial distress levels are the most visible across Support Services (86,725), Construction (86,312) and Real Estate & Property Services (68,744). The highest year-on-year increase in significant financial distress levels can be seen across Hotels & Accommodation (+15.4%), Real Estate & Property Services (+12.1%) and Leisure & Cultural Activities (+9.5%).

Shaun Barton, National Online Business Operations Director at Real Business Rescue, commented on the latest release of the Business Distress Index:

“As UK businesses enter a new tax year, they must keep their foot on the pedal to navigate rising operating costs and steer clear of loading on unnecessary financial weight. With market conditions growing harsher, businesses must operate leaner, which can be achieved through strategic cost-cutting, streamlining and restructuring.

“The tax burden on businesses is growing heavy as employers bear higher rates of National Insurance Contributions and National Living Wage, along with additional tariffs on exports to the US for some sectors. With little financial relief available to businesses, tightening company wallets is more vital than ever.”

The region with the highest financial distress levels is London, with 14,889 companies in critical financial distress, compared to 12,089 companies in Q1 2024 – a 23% rise. With SMEs making up most of the business population in London, the capital typically tops the table of distressed regions. London is followed closely by the South East of England with 6,860 SMEs in critical financial distress, a slight 7% increase from last year.

In summary, the sectors that saw the highest jump in significant financial distress over the last year include Hotels & Accommodation, Real Estate & Property Services and Leisure & Cultural Activities. With significant tax changes in force, investors are holding on to funding, and consumers are ringfencing funds for essential spending.

The next release of the Business Distress Index will show the early impact of tax changes, along with US tariffs absorbed by key sectors.

If your company is experiencing cash flow problems and creditor pressure as a result of rising overheads, unmanageable company debts and US tariffs, get in touch with one of our in-house licensed insolvency practitioners to discuss a business survival strategy. We can advise on a range of company restructuring and liquidation options to help achieve a cost-efficient rescue or exit. We offer a free, confidential consultation and a dedicated director advice line for urgent insolvency support.

For Ltd Company Directors

What are you looking to do?

Choose below:

We provide free confidential advice with absolutely no obligation.

Our expert and non-judgemental team are ready to assist directors and stakeholders today.

Understand your company's position and learn more about the options available

Find your nearest office - we have more than 100 across the UK. Remote Video Meetings are also available.

Free, confidential, and trusted advice for company directors across the UK.