Understand your company's position and learn more about the options available

Require Immediate Support? Free Director Helpline: 0800 644 6080

Free Director Helpline: 0800 644 6080

The latest business distress index which provides a snapshot of the financial health of UK businesses shows that UK businesses continue to experience challenging trading conditions. While businesses await tax reforms due to be announced in the Autumn Budget, political and economic uncertainty compounds existing problems, such as the cost of living crisis and high inflation.

We highlight how businesses fared throughout Q3 2024 (July to September), during which the UK Election triggered a change in the goalposts for UK businesses.

The Business Distress Index for Q3 2024 connects the dots between the financial health of UK companies and the rate of UK insolvencies.

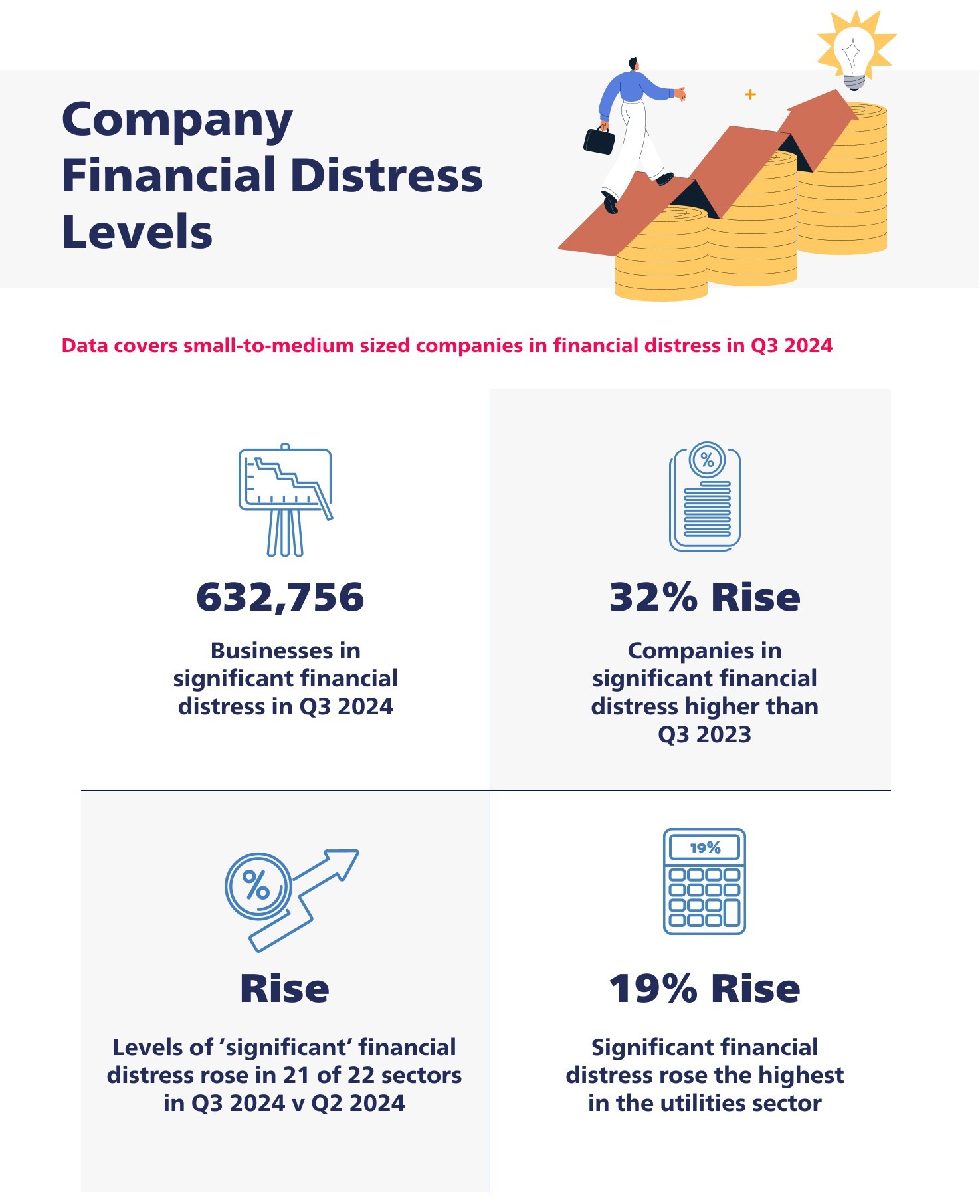

The Business Distress Index provides unique quarterly insights into the corporate health of UK businesses. The research shows 632,756 UK businesses are in ‘significant’ financial distress, up 5% on the previous quarter (601,950) and 32.3% higher than Q3 2023 (478,176).

Around 21 of the 22 sectors assessed as part of the Business Distress Index showed increasing levels of ‘significant’ financial distress in Q3 2024, compared to Q2 2024. The quarterly increase saw 30,000 companies pushed into worrying levels of financial distress. This highlights the volatile trading conditions businesses are facing, with a handful of key sectors under extreme pressure.

The sectors experiencing a notable increase in ‘significant’ financial distress include utilities (19.3%), food and drug retailers (10.4%), financial services (9.94%) and bars and restaurants (8.7%).

The sectors which saw more companies enter ‘critical’ financial distress include support services (4,860), construction (4,324) and real estate and property services (4,099). The sectors which saw a drop in critical financial distress levels include hotels and accommodation (33.5%), construction (28.5%) and real estate and property services (26.5%).

Shaun Barton, National Online Business Operations Director at Real Business Rescue, comments:

“As UK companies await new beginnings in 2025 following a year of political turbulence and unprecedented hardship as a direct result of the cost of living crisis, the stakes remain high.

“With businesses up against rising operational costs and fluctuating energy prices, they must remain on high alert to recognise the first looming signs of insolvency.

“With thirty per cent more businesses in significant financial distress in Q3 2024 than the previous quarter, high inflation continues to threaten UK businesses, along with Covid-19 legacy debt.

“High-profile construction companies have been catapulted into insolvency because of rising material costs, recruitment pressures and inflation which is expected to hit the sub-contractor community soon.

“While the new government is expected to restore stability and replenish the health of the British economy, only days will tell what path UK companies will take as the countdown to the Autumn Budget begins.”

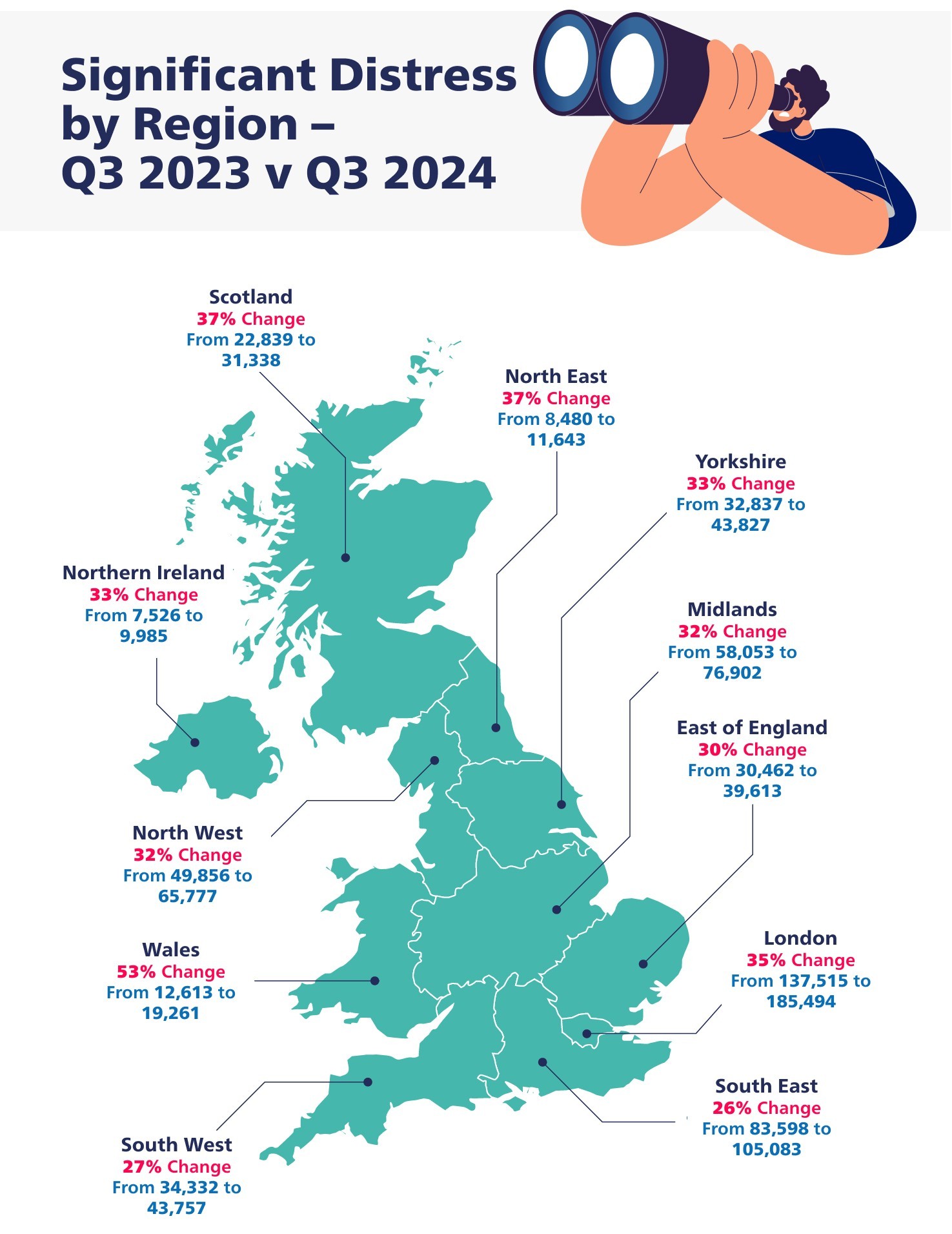

The top five regions that top the list of ‘critical’ and ‘significant’ financial distress by region include London, South East, Midlands, North West, and Yorkshire.

The number of businesses in significant financial distress in Q3 2024, compared to Q3 2023, increased in London (35%), South East (26%), Midlands (32%), North West (32%), and Yorkshire (33%).

The sectors with the highest number of businesses in critical and financial distress in Q3 2023 continue to top the table in Q3 2024. This includes construction, support services, and real estate and property services.

The construction sector has been hard hit by high inflation which has impacted borrowing, and investor and buyer appetite. The cost of living crisis, rising energy bills and talent acquisition problems continue to compound financial problems for construction companies. These issues echo into the real estate and property services sector and support services.

If your company is struggling with business debts, creditor pressure or the possibility of an uncertain future, you are not alone. We help company directors just like you every single day, and we are here to give you the help and advice you need.

Call our team today on 0808 253 3818.

For Ltd Company Directors

What are you looking to do?

Choose below:

We provide free confidential advice with absolutely no obligation.

Our expert and non-judgemental team are ready to assist directors and stakeholders today.

Understand your company's position and learn more about the options available

Find your nearest office - we have more than 100 across the UK. Remote Video Meetings are also available.

Free, confidential, and trusted advice for company directors across the UK.